Direct vs Partner: 4 Things to Consider When Implementing Cloud ERP

The direct vs partner riddle is one that most companies encounter when implementing a cloud enterprise resource planning (ERP) system.

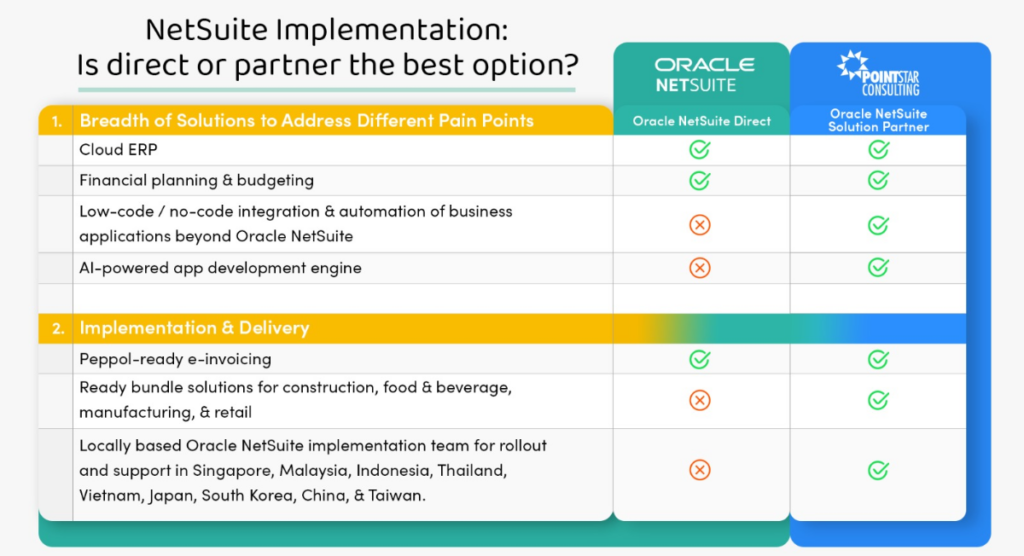

At the outset, the choice may seem simple. Why work with a partner like PointStar Consulting when a solutions provider, like Oracle NetSuite, is the maker of the software, right? Well, not that simple.

Businesses in the digital age operate using a variety of best-in-class solutions to address the different pain points they face. Meanwhile, direct sellers may not often offer solutions for all your pain points, beyond their realm of speciality.

In an age where high-growth businesses have stacks of solutions to fuel their operations, there is no single “silver-bullet” solution that can resolve the different challenges businesses face. This is when the variety of specialised solutions and services offered by a partner like PointStar Consulting shines through.

1. Financial Digital Transformation Consultancy

Oracle NetSuite provides you with the world’s No. 1 cloud ERP system to manage critical financial processes such as financial planning and budgeting. Oracle NetSuite has been the flag bearer when it comes to financial processes management. It operates fully on the cloud, offers a robust financial management solution for high volumes of transactions, and automates tedious processes.

Meanwhile, PointStar Consulting provides businesses on a high-growth trajectory with a comprehensive suite of specialised financial cloud solutions that complement Oracle NetSuite. These include solutions such as BlackLine that help accommodate high-value, high-volume transactions by automating bank reconciliations and accelerating the financial close process.

PointStar Consulting also has strong partnerships with a variety of cloud solutions providers that specialise in other accounting and financial processes management, such as PyanGo, which provides automated budgetary control for users of the Oracle NetSuite cloud ERP system, and Netgain, which is a built-for-Oracle Netsuite native regulatory compliance software that helps companies, especially those in the leasing business to adhere to standards such as IFRS 16, ASC 842, and GASB 87.

2. Presence cutting across different countries and regions

One of the primary benefits of working with a partner is that they have a presence in the region that you are based in, if not the country. PointStar Consulting, for instance, has a presence in Singapore, where it is headquartered, but also in Malaysia, Indonesia, Thailand, Vietnam, Japan, South Korea, China, and Taiwan. While the direct software maker may be available in many regions, partners still carry out the implementation. The competence, experience, and reputation of the partner implementing the Oracle NetSuite cloud ERP system is extremely important as it is a complex and costly undertaking with far-reaching benefits.

The key takeaway here is that when you engage in the services of a stellar local partner, you often experience the intimacy of being served by a team of consultants whom you can always rely on when you need help. Partners like PointStar Consulting also have extensive experience and regional understanding that is decisive as they understand the problems that businesses face that may be unique to the region or country that they are operating in.

3. Comprehensive Set of Solutions Bundled Together to Address Your Different Pain Points

When working directly with a software developer, you will quickly realise that their expertise, while impressive, is limited to the products that they sell. Whereas, for a partner like PointStar Consulting – with 14 years of experience in various countries – the breadth and depth of solutions offered are wide and deep.

PointStar Consulting offers a variety of cloud systems that, when bundled together, offer you a comprehensive solution to address your different pain points. Our partnership with Workato enables businesses to integrate their stack and unleash automation at scale. Workato’s low-code, no-code platform enables businesses to integrate the different solutions critical to the operations of their business with very little technical expertise required.

Meanwhile, our partnership with BlackLine helps us deliver a cloud accounting solution that builds on Oracle NetSuite’s robust financial features to automate reconciliations and significantly reduce financial close time.

4. Extensive Experience

The experience of serving customers in Asia for over 14 years has also allowed PointStar Consulting to develop a keen understanding of the common business challenges in the region, and the shortcomings and strengths of different systems. This allows PointStar Consulting to seek partners whose solutions complement Oracle NetSuite and identify gaps to offer a comprehensive solution that addresses a company’s different pain points.

While it continues to provide stellar services to its Oracle NetSuite customers as evidenced through its dedicated customer success division, PointStar Consulting has also solidified its position as the one-stop consultancy that businesses go to when they undertake their financial digital transformation.

Our presence at the local level also allows us to hire highly skilled locally-based consultants, who understand your unique needs.