Workday Adaptive Planning Dashboards Analytics Datasheet

Form Submission - Download

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

Extraordinary macroeconomic transformations have introduced novel risks to the business landscape. As a response to the situation, finance teams must improve their risk assessment and risk management practices by capitalising on data from all areas of the company and involve data from beyond the business in risk management.

By combining internal and external data sources, your business can effectively reduce blind spots and minimise uncertainties. This enhanced visibility will provide a solid foundation for making informed and strategic decisions. While the integration of external data sources will offer valuable insights into the conditions of partners, suppliers, competitors, customers, and other market dynamics.

Now is the time to refine your risk management process, leveraging the power of data consolidation and the integration of external data sources. By doing so, your business can mitigate blind spots, supercharge decision-making, and position itself to sustainable growth and success in the current business landscape.

In today’s business landscape, recognising the value of utilising both internal and external data for decision-making is crucial. However, transforming this recognition into a reality can be challenging. Many businesses have data scattered across various systems that lack connectivity, such as ERPs, ecommerce platforms, project management systems, and spreadsheets. Moreover, even when these systems are connected, it is often not specifically for risk management purposes.

To address these challenges, CFOs are taking on the role of technology champions and collaborating with the rest of the C-suite. Among the arsenal of tools at their disposal, a cloud data warehouse is one of them.

A cloud data warehouse serves as a central repository that consolidates data from different areas of the business. It goes beyond internal data by incorporating external data sources, and it can also preserve data from legacy systems, giving businesses the flexibility to retire them when needed. By integrating data from multiple systems, such as financial, operational, and customer data, risk managers gain a comprehensive view of the companies’ risk landscape. This integrated data approach enables better risk identification, assessment, and monitoring.

By adopting a cloud data warehouse, businesses can optimise their risk management efforts and proactively identify, assess, and mitigate risks, which ultimately enhances their ability to navigate the ever-changing business landscape with confidence.

Disconnected subsidiaries can pose a significant risk to business operations, especially when it comes to managing costs effectively. In many cases, organisations struggle to obtain a comprehensive view of financial performance across subsidiaries, leading to inefficient and manual processes for data aggregation and analysis. This lack of visibility hampers decision-making and planning efforts, while also incurring substantial costs to maintain disparate systems.

However, by leveraging the role of a cloud data warehouse, businesses can mitigate this risk and achieve better cost control. For instance, once there was a manufacturer that faced similar challenges with 15 independently operating subsidiaries. To address the issue, they consolidated their data in Oracle NetSuite Analytics Warehouse, eliminating the need for manual data manipulation in spreadsheets and BI tools.

This consolidation enabled the manufacturer to gain a holistic view of financial and operational performance across subsidiaries, providing valuable insights for planning and decision-making. Moreover, by sunsetting their old infrastructure and relying on the cloud data warehouse, they significantly reduced costs by 66%. The entire team now had access to visualisations of each subsidiary’s financial and operational performance, enabling them to identify cost-saving opportunities and streamline their overall financial management.

Achieving sales targets is a critical objective for businesses, but inadequate visibility into sales channels can significantly hinder this goal. In one case, an accessories retailer faced challenges in forecasting sales across multiple channels. Their existing business intelligence (BI) tool struggled to aggregate and analyse data from various sources such as multiple Shopify instances, Google Analytics, Google Ads, and more.

To overcome this challenge and mitigate the risk of missed sales targets, the retailer transitioned to Oracle NetSuite Analytics Warehouse, which proved instrumental in improving their channel visibility. With the cloud data warehouse, they gained the capability to effortlessly integrate and analyse data from each of these diverse sources.

By leveraging a cloud data warehouse solution like Oracle NetSuite Analytics Warehouse, businesses can seamlessly integrate data from multiple sources, apply advanced analytics capabilities, and enhance their forecasting accuracy. The result is improved visibility into sales channels, optimised inventory management, and increased sales performance, ultimately mitigating the risk of falling short of sales targets.

In today’s fast-paced business environment, the accuracy and timeliness of inventory data are crucial to meet customer demands. However, relying on outdated inventory data poses a significant risk for businesses. One example comes from Oracle NetSuite’s customer, a drinkware wholesaler, that struggled to respond effectively to changes in customer demand due to manual processes. Their team would manually export data from their ERP and ecommerce systems into spreadsheets to track inventory levels, leading to delays and the use of stale data. Recognising the potential impact on customer satisfaction and retention, the wholesaler sought a solution.

By leveraging the power of Oracle NetSuite Analytics Warehouse, the wholesaler overcame the challenges associated with outdated inventory data. The cloud data warehouse enabled the integration of data from the ERP system with Google Analytics, providing a comprehensive view of inventory activity. With the solution’s automated capabilities, the wholesaler now receives daily inventory scorecards and SKU-level forecasts. This empowers the team to anticipate and respond to customer demand more effectively, resulting in improved customer retention, cost reduction, and the ability to seize opportunities in a rapidly changing market.

By replacing manual processes and spreadsheets with a cloud data warehouse like Oracle NetSuite Analytics Warehouse, businesses can blend data from different sources, automate reporting and forecasting, and gain real-time insights into inventory levels.

In a highly volatile environment where business success is largely driven by cutting-edge technology, the ability to make the most out of available data makes a huge difference.

Data from disparate sources that are not integrated can be rendered useless. Finding robust analytical solutions to make the most out of your data is critical.

Even more critical is your choice when choosing which cloud solutions provider to work with. While working directly with a solutions provider has its allure, it is worth noting that a solutions partner like PointStar Consulting provides a comprehensive suite of solutions that cater to your business needs. Solutions providers like PointStar Consulting have the technical expertise, regional presence, and a keen understanding of different business pain points to offer organisations a highly customised suite of solutions addressing each business’s needs.

As the business landscape becomes increasingly complex, cloud Enterprise Resource Planning (ERP) systems are no longer a luxury but a necessity for companies looking to stay competitive.

Today’s cloud ERP systems are advanced software solutions that are designed to integrate and automate essential financial and operational functions within a company. They provide a centralised database that allows for easy access to critical business data, including general ledger (GL), accounts payable, accounts receivable, payroll, and financial reporting.

Modern cloud ERP systems go beyond just financial management. They also provide functionality for inventory management, order management, and supply chain management, as well as procurement, production, distribution, and fulfilment. This allows businesses to manage their operations more effectively and efficiently.

In order to fully leverage the power of cloud ERP systems, companies should have a good understanding of the 12 core cloud ERP features.

Integration is a critical component of a cloud ERP system. The primary benefit of cloud ERP is its ability to integrate different solutions in your organisation to provide you with a centralised view of essential financial, operational, and business data in near-real-time. By integrating different data, cloud ERP systems eliminate data silos and provide a single source of truth for the organisation. It will ensure that everyone has access to the same up-to-date information and share the data accurately and efficiently across the company.

Cloud ERP systems provide companies with the ability to automate repetitive business tasks, such as: payroll, order processing, invoicing, reporting, and more. By automating these tasks, cloud ERP systems can minimise the time spent on manual data entry, reduce errors, and enable employees to focus on more value-added tasks.

Cloud ERP systems also provide the ability to automate complex workflows, which can involve multiple departments and processes. For example, an inventory tracking module could automatically trigger a shipment and invoice when a certain SKU becomes available. This not only reduces the time required to complete the task but also ensures that all departments are working together and sharing the same data.

Cloud ERP systems collect and store vast amounts of data from various functions, such as finance, procurement, inventory, sales, and marketing. This data can be used to generate meaningful insights that can help businesses make better decisions and improve their operations.

According to Brainyard’s Winter 2020 survey, CFOs and business leaders have long recognised the power of data analysis, as it enables them to identify new business opportunities, optimise current operations, reduce costs, detect fraudulent activities, and improve customer satisfaction. With cloud ERP systems, data analysis can be performed in real-time, enabling businesses to stay on top of trends and respond quickly to changing market conditions.

Reporting is another important role of cloud ERP systems. Cloud ERP systems provide businesses with a wealth of data from various sources, and reporting tools allow businesses to turn that data into actionable insights. Reports generated by the cloud ERP system can help businesses identify problem areas before they become major issues. It can also help businesses optimise their processes and identify opportunities for improvement.

With better reporting capabilities, executives and managers can make more informed decisions based on the data presented in the reports. The ability to quickly generate reports also means that information is more readily available and can be acted upon in a timely manner.

Tracking and visibility are key features of cloud ERP platforms that enable companies to monitor, analyse, and optimise their business operations.

Tracking refers to the ability to monitor and record various aspects of business operations, such as sales orders, purchase orders, inventory levels, production schedules, and delivery timelines. By tracking these metrics in real-time, companies can quickly identify potential issues and take corrective actions to minimise any disruptions to their operations. This also enables companies to make informed decisions based on accurate and up-to-date data, which can ultimately lead to improved efficiency, reduced costs, and increased profitability.

Visibility, on the other hand, refers to the ability to surface and understand business metrics by providing real-time access to data across the organisation. By breaking down information silos and offering reporting and analysis for every aspect of business operations, cloud ERP platforms enable companies to gain a holistic view of their business performance. This allows them to identify trends, patterns, and opportunities for improvement, which can be leveraged to optimise operations and increase revenue.

Accounting is a critical component of a cloud ERP system that enables organisations to track, store, and analyse financial data. Cloud ERP accounting features typically include capabilities such as accounts payable (AP), accounts receivable (AR), general ledger (GL), budgets, and forecasting. Additionally, many cloud ERP systems may offer more advanced features such as tax management, fixed assets management, revenue recognition, and multi-currency reconciliation.

One of the key benefits of cloud ERP accounting functionality is the ability to decrease the time it takes to reconcile and close monthly financial statements. Month-end closes can be a time-consuming process that involves reconciling various accounts, reviewing transactions, and generating financial statements. Cloud ERP accounting features can help automate and streamline many of these tasks, reducing the time and effort required to complete them.

Cloud ERP systems play a significant role in financial management by providing a centralised platform for tracking and managing financial data across a company. As financial management is a critical task for businesses that involves planning, organising, and utilising funds to achieve the company’s objectives, a cloud ERP system can assist finance teams in managing these complex tasks.

Customer Relationship Management (CRM) refers to the strategies, processes, and technologies that companies use to manage and analyse customer interactions and data throughout the customer lifecycle. Integrated CRM features in a cloud ERP system allow organisations to incorporate customer relationship data into their operations, expanding their business view and enhancing customer service.

Cloud ERP systems with integrated CRM features can help organisations improve their sales and marketing efforts by providing better insights, automating processes, and enhancing collaboration between teams. With integrated CRM features, cloud ERP systems can provide real-time insights into sales trends, customer behaviour, and also can provide a more personalised and tailored experience to customers. This can lead to higher customer satisfaction and loyalty, as well as increased sales revenue.

The Human Resources (HR) component of a cloud ERP system is designed to manage all aspects of employee management, from recruitment and hiring to payroll and benefits administration. With an integrated HR module, organisations can streamline their HR processes and reduce manual workloads. Therefore, automating HR processes with a cloud ERP system can save time, and reduce the risk of costly errors. This frees up HR staff to focus on more strategic tasks, and help companies to improve the employee experience.

Supply Chain Management (SCM) refers to the planning and management of all activities involved in the production and distribution of a product or service. A cloud ERP system with SCM functionality enables businesses to streamline and optimise their supply chain operations by tracking and analysing data related to demand, inventory, manufacturing processes, logistics, and distribution.

Cloud ERP systems have long played an important role in manufacturing, providing businesses with a centralised platform to manage various aspects of their production processes. With cloud ERP, manufacturers can streamline product planning, monitor production, and forecast demand. The system can also assist with sourcing raw materials and managing the assembly process.

Oracle NetSuite is a cloud enterprise resource planning (ERP) system that brings together multiple business functions in one unified platform. This cloud-based software is designed for enterprises across various industries. It offers real-time insights, streamlined customer service, and reduced supply chain costs through the integration and automation of essential financial and operational functions. These functions include inventory management, order and supply chain management, procurement, production, distribution, and fulfilment.

With Oracle NetSuite cloud ERP, businesses can benefit from a centralised platform that eliminates data silos, reduces manual errors, and enhances overall efficiency. The system allows for greater visibility and control over all aspects of the business, from finance to HR to sales and marketing. This integration helps businesses make better-informed decisions by providing real-time data insights and reports.

Financial modelling is a superpower.

A superpower that lets you test your assumptions and hypotheses across dimensions, versions, and time before executing budgets and plans.

A well-formulated model lets you run unlimited scenarios across any program, department, or business unit according to your fiscal calendar or other business milestones. In other words, dynamic financial models show you the probable results of pulling various levers (e.g., adding headcount, reducing production time, expanding sales territories) to see likely outcomes.

Not exactly X-ray vision, but close.

Yet if financial modelling is a superpower, outdated tools and manual processes that limit the number and types of scenarios you can run are kryptonite.

Let’s look at how to generate flexible and robust financial models powerful enough to drive strategic decisions and help your business surpass the competition in a single bound.

Ideally, financial models should be robust and flexible enough to accommodate current circumstances and multiple queries. If your team is bogged down aggregating data from multiple sources and making sure spreadsheets are accurate, modelling takes a back seat to fix errors and broken formulas.

According to an Adaptive Insights CFO Indicator Report, 71% of finance teams manage data from at least three sources. When data is aggregated manually from multiple sources and managed in spreadsheets, it’s often laborious, error-prone, and inaccurate.

Financial modelling that works in today’s fast-paced business models should automate these processes and free your time to test your hypotheses.

Robust models should let you model everything, everywhere—expenses, capital, headcount, revenue, projects, grants, quotas, and territories—across any department, entity, or function.

Your financial model is an opportunity to check in with stakeholders, gather information about priorities and plans, and create a set of assumptions that improve decision-making throughout your organization.

Done well, financial models teach you and the people in your organization something: a new way of doing business, in-depth information about the competitive landscape, or the factors that might support or detract from corporate objectives and KPIs.

Robust and effective financial models should accomplish the following:

A single source of data truth that is accessible, relevant, and flexible enough to respond to emerging market conditions ensures that there’s a united front and full alignment behind the same objectives. When everyone agrees on the validity and accuracy of the data, there is less bickering over the numbers and more collaboration between business units.

If everyone is fighting about the validity of data sources, the process will be caught up in arguments instead of strategic decision-making. From extensive cost allocations, multiple budget versions, and various organizational structures, your financial models and analytics should build confidence in the numbers and the models.

Outdated tools and manual processes take too much time to generate insights. By automating planning, budgeting, and forecasting tasks, your team will have more time to run unlimited what-if scenarios and answer multidimensional queries in real-time.

Everyone in your organization is modelling—whether they know it or not. By making financial data modelling tools broadly available to business units and ensuring that tools are user-friendly, you’ll allow everyone to weigh in—on assumptions about headcount, product releases, and more. After all, true collaboration results in better financial models.

Modern businesses require financial modelling and analysis capabilities that enable on-the-fly queries, limitless what-if scenarios, and testing. Proliferating data, outdated tools, and a rapidly changing market make continuing with the same-old, same-old a strategic mistake.

An intelligent, scalable, and comprehensive cloud-based planning platform that gives you the power you need to support the sophisticated and robust financial planning, modelling, and analytics modern businesses require.

This form is required for visitor to download the whitepapers and/or datasheets.

"*" indicates required fields

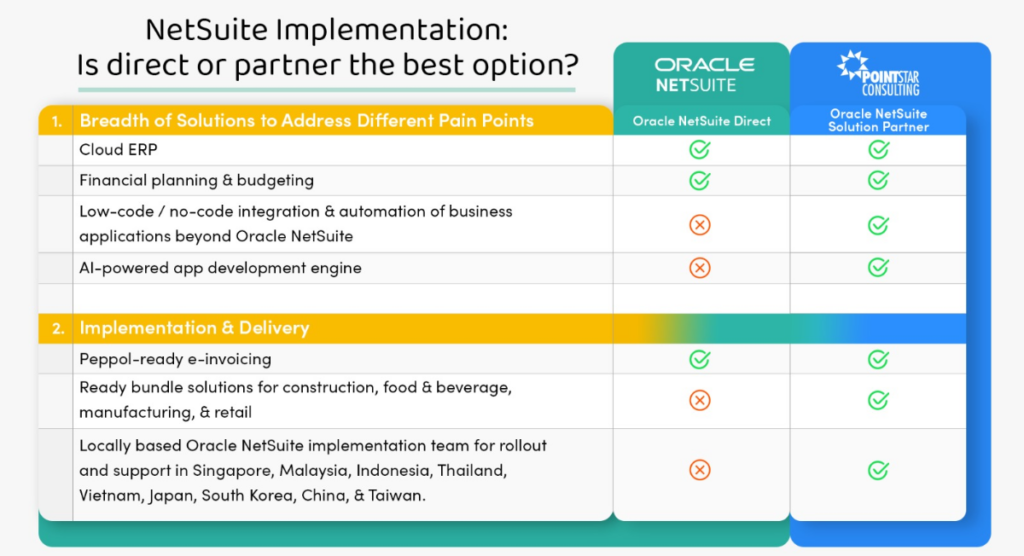

The direct vs partner riddle is one that most companies encounter when implementing a cloud enterprise resource planning (ERP) system.

At the outset, the choice may seem simple. Why work with a partner like PointStar Consulting when a solutions provider, like Oracle NetSuite, is the maker of the software, right? Well, not that simple.

Businesses in the digital age operate using a variety of best-in-class solutions to address the different pain points they face. Meanwhile, direct sellers may not often offer solutions for all your pain points, beyond their realm of speciality.

In an age where high-growth businesses have stacks of solutions to fuel their operations, there is no single “silver-bullet” solution that can resolve the different challenges businesses face. This is when the variety of specialised solutions and services offered by a partner like PointStar Consulting shines through.

Oracle NetSuite provides you with the world’s No. 1 cloud ERP system to manage critical financial processes such as financial planning and budgeting. Oracle NetSuite has been the flag bearer when it comes to financial processes management. It operates fully on the cloud, offers a robust financial management solution for high volumes of transactions, and automates tedious processes.

Meanwhile, PointStar Consulting provides businesses on a high-growth trajectory with a comprehensive suite of specialised financial cloud solutions that complement Oracle NetSuite. These include solutions such as BlackLine that help accommodate high-value, high-volume transactions by automating bank reconciliations and accelerating the financial close process.

PointStar Consulting also has strong partnerships with a variety of cloud solutions providers that specialise in other accounting and financial processes management, such as PyanGo, which provides automated budgetary control for users of the Oracle NetSuite cloud ERP system, and Netgain, which is a built-for-Oracle Netsuite native regulatory compliance software that helps companies, especially those in the leasing business to adhere to standards such as IFRS 16, ASC 842, and GASB 87.

One of the primary benefits of working with a partner is that they have a presence in the region that you are based in, if not the country. PointStar Consulting, for instance, has a presence in Singapore, where it is headquartered, but also in Malaysia, Indonesia, Thailand, Vietnam, Japan, South Korea, China, and Taiwan. While the direct software maker may be available in many regions, partners still carry out the implementation. The competence, experience, and reputation of the partner implementing the Oracle NetSuite cloud ERP system is extremely important as it is a complex and costly undertaking with far-reaching benefits.

The key takeaway here is that when you engage in the services of a stellar local partner, you often experience the intimacy of being served by a team of consultants whom you can always rely on when you need help. Partners like PointStar Consulting also have extensive experience and regional understanding that is decisive as they understand the problems that businesses face that may be unique to the region or country that they are operating in.

When working directly with a software developer, you will quickly realise that their expertise, while impressive, is limited to the products that they sell. Whereas, for a partner like PointStar Consulting – with 14 years of experience in various countries – the breadth and depth of solutions offered are wide and deep.

PointStar Consulting offers a variety of cloud systems that, when bundled together, offer you a comprehensive solution to address your different pain points. Our partnership with Workato enables businesses to integrate their stack and unleash automation at scale. Workato’s low-code, no-code platform enables businesses to integrate the different solutions critical to the operations of their business with very little technical expertise required.

Meanwhile, our partnership with BlackLine helps us deliver a cloud accounting solution that builds on Oracle NetSuite’s robust financial features to automate reconciliations and significantly reduce financial close time.

The experience of serving customers in Asia for over 14 years has also allowed PointStar Consulting to develop a keen understanding of the common business challenges in the region, and the shortcomings and strengths of different systems. This allows PointStar Consulting to seek partners whose solutions complement Oracle NetSuite and identify gaps to offer a comprehensive solution that addresses a company’s different pain points.

While it continues to provide stellar services to its Oracle NetSuite customers as evidenced through its dedicated customer success division, PointStar Consulting has also solidified its position as the one-stop consultancy that businesses go to when they undertake their financial digital transformation.

Our presence at the local level also allows us to hire highly skilled locally-based consultants, who understand your unique needs.

For all their use of modern technology to deliver ease of use to consumers, many fintech businesses still find themselves manually managing their back office processes. These processes are riddled with human errors and data duplications.

The cloud enterprise resource planning (ERP) system is one that is at the forefront of technologies that are helping businesses automate manual processes and introduce operational efficiencies.

Automation of key financial processes – The manual management of data through spreadsheets result in human errors and data duplication. Mistakes like this can delay financial close time, and affect the financial standing of fintechs, in addition to resulting in costly fines by regulatory authorities. This puts the onus on fintechs to equip themselves with the best that cloud technology has to offer.

Cloud ERP systems help businesses automate key processes such as bank reconciliations, helping fintechs accelerate their close times. Endeavours such initial public offering (IPO) require businesses to rigorously report their finances. Cloud ERPs deliver robust financial reporting functionalities that ensure fintechs are well prepared for an IPO.

Multi-company Financial Consolidation – Fintechs need cloud solutions that can help deliver a consolidated and global view of all their businesses and subsidiaries in different countries. Cloud ERP systems are equipped with global financial management tools that deliver visibility, and are also preconfigured to cater to different currencies, and languages.

Hardly a day goes by without regulatory authorities mulling the imposition of new regulations on fintech businesses. Cloud ERP systems are also preconfigured to enable financial reporting according to global regulatory requirements, ensuring fintechs seamlessly manage their finance on one platform serving as a single source of truth.

Scalability – Fintech businesses operate in an industry that is presently primed for growth. Unfortunately, legacy systems and other small scale solutions do not have the ability to accomodate the often meteoric growth prospects of fintech.

Fintechs will quickly realise that a system that is built to handle 50 users may never be able to handle 500 users. Cloud ERP systems, due to the virtue of their architecture, cloud ERP systems allow fintechs to scale in parallel to their growth. You can often add users and customise the system in line with the growth of your business.

360-degree, real-time visibility – The financial markets that fintech businesses operate in can often be highly disruptive and volatile. The suite of different, best-in-class solutions that fintechs use can sometimes resemble a mountainous stack. Oftentimes these systems are not integrated, do not talk to each other, and end up in silos, greatly diminishing the value of data.

Cloud ERP systems offer robust integration functionalities that can help the different solutions that fintech businesses use, giving business owners a 360-degree, real-time view of their business processes and customers. This can significantly aid fintech businesses in unlocking key insights that can fuel their growth.

When facing mounting challenges posed by an increasingly disruptive marketplace, and also a volatile global business environment, there is little time to stop and think of ways to resolve problems, or innovate.

Cloud solutions such as an ERP system are equipped with robust forecasting tools that enable businesses to plan for their future. A cloud ERP solution also unifies data and provides fintechs with key insights for business growth. The real-time nature of the data you receive with cloud ERP solutions enables you to have your finger on the pulse and respond quickly to changing market or consumer trends.

The Oracle NetSuite system comes with robust functionalities that will serve fintech businesses well. This cloud ERP helps fintech businesses automate financial processes such as reconciliation and allows them to close fast and with confidence.